Democratizing Wealth Management: How Wealthy is changing the way India saves and invests in a surging economy

India is experiencing a seismic shift as a rapidly growing middle class finds itself with more disposable income than previous generations. This has catalyzed new demand for tailored financial advice and products. However, the wealth management industry remains fragmented, targeting HNIs and leaving behind the mass affluent.

Wealthy presents a timely solution.

By empowering a network of financial advisors, Wealthy unlocks personalized wealth management for the underserved Indian middle class. Advisors on Wealthy gain access to a diverse array of 150+ financial products spanning investments, insurance, and loans. For customers, this means financial plans tailored to their unique needs instead of a one-size-fits-all bank account. Advisors are incentivized to build lasting client relationships, with the platform ensuring superior economics versus targeting HNIs alone.

Wealthy’s founding team of Aditya and Prashant intimately understands this market, having witnessed the gap first-hand. As entrepreneurs themselves, they built Wealthy to empower fellow advisors to become financially independent while better serving clients. The platform equips advisors with state-of-the-art tools to provide a modern wealth management experience.

This proposition has struck a chord. The key drivers of this business model are:

Increasing ARPU: Recurring revenue streams on investment products, and growth of customer accounts

% split of take rate: Find a balance between the earnings of Wealthy and advisors

Lower CAC & retention costs: Acquire, activate, and then retain advisors at a low cost

Servicing costs: Keep operational costs in control given low take rates

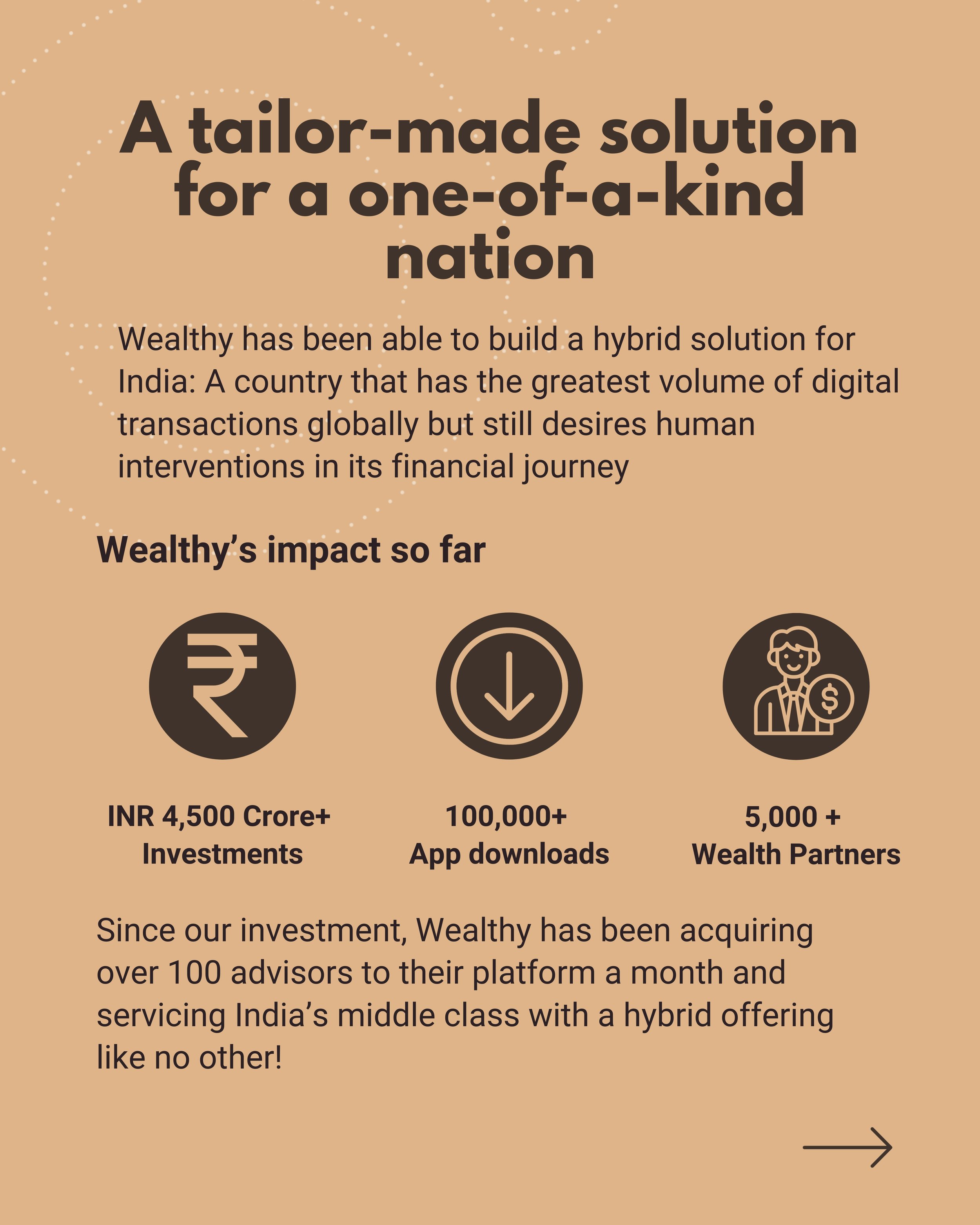

Wealthy has grown multi-fold and currently acquires more than 100 advisors every month, with a line of sight to make this number 200. Advisors experience material income growth, with many quitting their jobs to fully leverage Wealthy’s offerings. The team has achieved a staggering >80% 12-month advisor retention, translating opportunities into sticky partnerships.

Still quite early in its journey, Wealthy has accumulated key insights about driving engagement. As advisors spend more time on the platform, their earnings increase dramatically. Wealthy’s optimization training and superior economics keep advisors active, leading to a flywheel effect of higher revenues for both the advisors as well as the platform.

A key insight driving the business is that people still prefer human touchpoints for money management in India. Wealthy's advisor network provides the ideal hybrid of digital capabilities and personalized advice. This empowers the middle class with tailored financial plans while creating fulfilling entrepreneurial careers for advisors.

We couldn’t be more excited to partner with Aditya, Prashant and the Wealthy team. They embody our thesis of using technology to unlock opportunities for aspiring Indians across the country. We look forward to supporting Wealthy as they revolutionize wealth management for the middle class. The best is yet to come.